Hello All,

This is the sixth issue of the LSMIF newsletter. Please share with your friends and family and message in the Discord to participate and share a story!

Current News and Affairs:

Janet Yellen to signal further US support for deposits at smaller banks: Treasury secretary to defend ‘decisive and forceful actions’ by regulators to avert broader crisis… To me this is having a broken leg then stubbing your toe and only focusing on the toe. Yes it hurts but it is not your only problem. (Weird analogy I Know) The point is inflation is going to runaway again and GDP growth will slump, markets will tumble and again, they are only focusing on saving banks. 2008. That is all.

Nato expects allies to agree 2% defence spending “as a minimum” – If you own Lockheed Martin, Raytheon Technologies, General Dynamics, or any defence stock, enjoy your money because these stocks are going to do well with this announcement. A little known fact about Nato defence spending agreements are that the US get a large proportion of these contracts as a standard of the agreement.

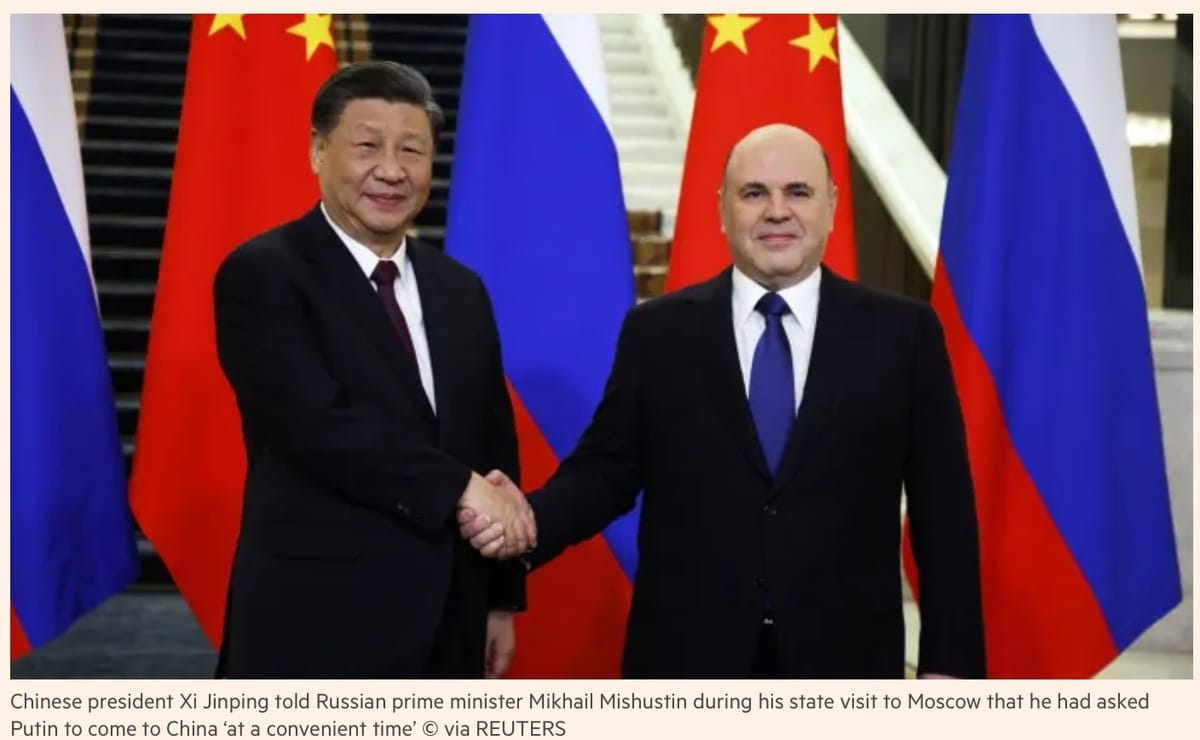

Xi Jinping invites Putin on state visit to China: I mean if this isn’t terrifying I’m not sure what is. The cosy relationship between Russia and China with their increased gold-buying, moving away from the dependency on the dollar is really pivotal in the sense of what is to come.

Google launches Bard chatbot to rival OpenAI’s ChatGPT: Tech giant seeks to make up lost ground in race to commercialise generative AI… I find this pretty exciting to be honest because when the big hitters all get involved they essentially spark an arms race and we get some very ingenious tech out of it. Watch this space closely.

Scottish Mortgage chair to step down in shake-up: McBain exits after rare public row over corporate governance… The fund owns some and seeks to buy more of this stock so this is something we should keep our eye on for sure.

UK public borrowing rises on energy support schemes: February figures of £16.7bn is higher than expected… Again, not to be that guy but 2008.

B&Q owner Kingfisher reports 20% drop in profits: They see profits falling even further this year so I might look to short this stock if I’m honest.

Fund News:

- Rebalancing Event: Thank you to all of you who turned up and to those of you who pitched your chosen stock. It was actually heartwarming to see the progress the fund has made this year! We held a poll and found that most of you agree with decisions pitched on current holdings and most of you voted for the purchase of both AstraZeneca and Unilever! So we will update you further with what price and size position we enter!

VOTING POLLS:

Below is two polls on some ERR companies chosen to be purchased and sold, please have a look and vote! This does not reflect all choices to be made, just some and is to double check decisions made in the Wednesday Meeting.

Commentaries:

- No commentaries this week, just some links to articles or sources I like to read or have read this week.

As always, thank you for your participation and attention.

Many Thanks,

LSMIF Management

Comments are closed.