Hello All,

This is the fifth issue of the LSMIF newsletter. Please share with your friends and family and message in the Discord to participate and share a story!

Current News and Affairs:

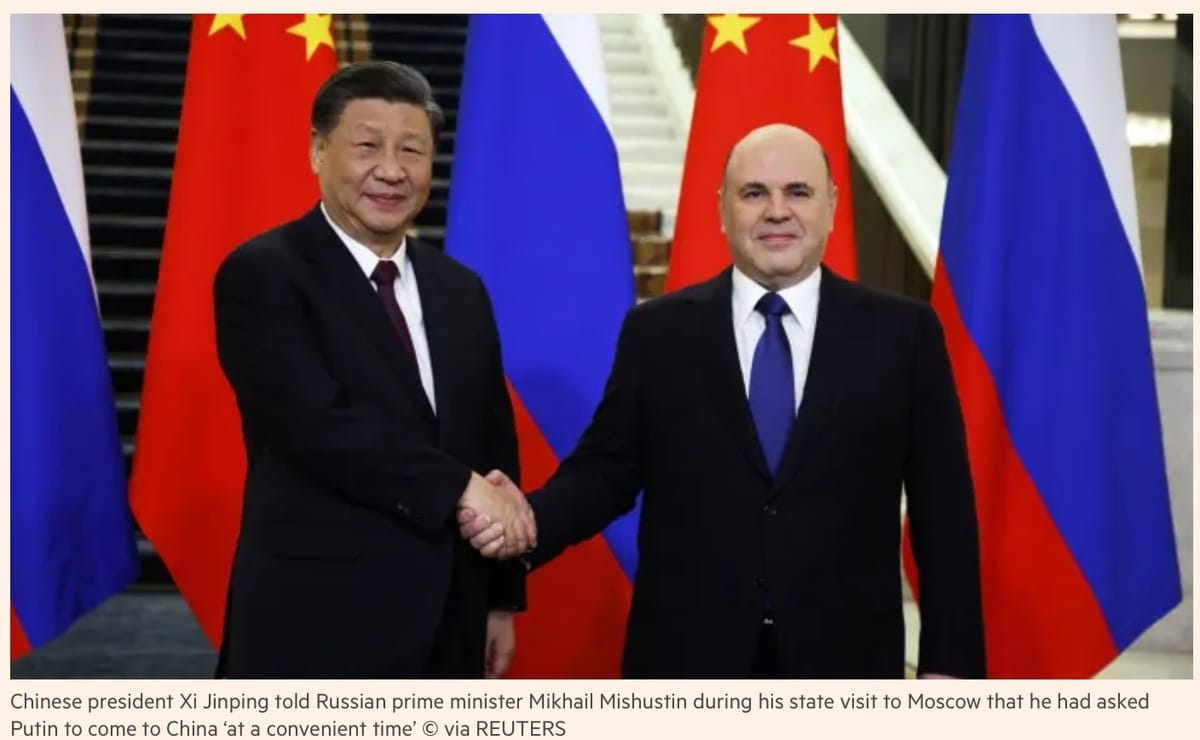

SVB Meltdown:The UK arm of SVB was sold to HSBC for £1 which is pretty hilarious. The US (main arm) is now in the process of government “bailouts” but this really begs the question, who’s next? Everyone seems to feel this is relatively contained but Credit Suisse’s stock price wobbled and a few other big bank’s have felt the pressure. Apollo, Blackstone and KKR among private capital groups eyeing SVB’s portfolio.

US consumer prices come in at 6% at tricky time for Fed amid SVB fallout: Data comes as central bank contends with broader concerns about how rising rates may have affected lenders – A rate rise follow through this week is still likely but now more risky…

ChatGPT maker OpenAi unveils new model GPT-4 – “most advanced system yet” – It is x500 times more powerful than 3.5…. They claim it exhibits “human-level performance” – It is multimodal so can accept both image and text forms and has many other apps embedded, such as Duolingo, Khan Academy and others.

SVB collapse forces rethink on interest rates and hits bank stocks: Two-year US Treasury bond yields record biggest one-day drop since 1987

Argentina’s inflation rate tops 100% for the first time in three decades!!!

Celadon becomes first UK medical cannabis group to win right to sell in Britain

Meta axes further 10,000 jobs in fresh round of cuts – strives to improve “efficiency”

China set to tighten grip over global cobalt supply as price hits 32-month low: Share of global output expected to reach 50% over next two years

UK Economy: IMF forecasts it will be the worst-performing large advanced economy this year. annual growth rates have more than halved since 2007-09. The economy is no bigger than before the pandemic and a recovery is not expected until 2026 (at the earliest) according to the BoE. Brexit slammed the brakes on UK investment. Now we are plagued by high inflation with no end in sight and a cost of living crisis amongst endless other things… We still aren’t at peak interest rates and loom in the limbo of a sizeable recession.

Credit Suisse to borrow up to $54B from Swiss central bank: Troubled lender’s shares rebound after Wednesday’s plunge of as much as -30%!

Jeremy Hunt’s giveaways in his budget announcement will have a marginal impact on UK growth, says watchdog: Office for Budget Responsibility says the country’s long-term growth prospects look no better than last November – while this free childcare and short-term budget balance seems good, it really won’t stimulate or save the economy as proposed

Fund News:

- Rebalancing Event: Thank you all so much for your attendance and participation yesterday! It was nice to see everyone turn up in smart attire and be really engaged in the presentation. I will upload pictures from the Marketing team next week!

- Next Steps: We’ve conducted our first vote of many… Please keep your eyes on Discord for the next votes and announcements where I will inform everyone of average PPS for new purchases, lot sizes, and general information.

- Management Recruitment for Next Year: As stated yesterday, we are in the process of creating an application process to recruit next year’s management. Please keep your eyes open for this!

- Looking Forward: We have another ERR for you all to do this year before certificates and we also have our last Investment Committee meeting of the year sometime next month. We will also be conducting fast-tracked trainee training for a new wave of trainee analysts in the next month.

Commentaries:

- SVB and Contagion Risks: If a few banks were so bad at managing interest rate risks and deposit outflow risk to blow up in a few hours, how do we know it won’t happen to other banks? SVB was a prime example of a bank holding a lot long-term Treasury bonds that when held to maturity, do return all the money invested plus interest but… SVB did not expect inflation and interest rate rises to go so high so fast and this caused a large loss in investment which led to them selling their investment at over a -$1.4B loss as well as having a lack of cash on hand to meet depositors withdrawal requests. This in turn led to a “bank run” where depositors withdrew their money and eventually SVB could not cope with this and did not have the funds to cover all the money. A lot of big companies like Circle and Roku held significant funds with SVB and many startups also felt pressure and the ripple effect from this meltdown. I think we are facing the prospect of an earnings recession and a “depression” in equity valuations.

- Cryptocurrency and Bitcoin: Bitcoin (as usual) has been experiencing extreme volatility but this is neither unusual or worrying to me. I still think we are in a downwards trend and the recent bank meltdowns are a sign of the magnitude of a following recession. I’d like to be wrong in this instance but in case I’m right… I have Bitcoin pricing in at $15k and below with a low target of $10k and $13.7k as my median. I will likely add a substantial position if it reaches these values and switch my options from shorts to longs. I think Bitcoin will have some slight upside essentially trading sideways in the short term but it will go back down and hopefully meet my targets. I also have to note that Circle, the company behind the USDC stable coin, hold $3.4B in funds with SVB and this led to the stable coin dropping from it $1 peg to $0.8. A -20% drop on a stable coin really brings some big questions for centralised stable coins. The cryptocurrencies I’m looking to add, and have added positions to previously, are Polygon ($MATIC), COTI ($COTI), Cardano ($ADA), Bitcoin ($BTC), and Algorand ($ALGO) – This is not financial advice, just what I’m buying or looking to. I am not a professional.

- My Picks: I either have a large position currently or seek to add some/more to: Blackstone, Gold (options and ETF), Bitcoin (options and currency), Blackrock, Bristol-Myers Squibb, PepsiCo, Unilever, Occidental Petroleum, Ecolab, Any India (Bombay Stock Exchange) ETF, Brookfield Renewable, Cobalt Long options – This is not financial advice, just what I’m buying or looking to. I am not a professional.

As always, thank you for your participation and attention.

Many Thanks,

Aymen Retibi

Chief Investment Officer, LSMIF Management